#GrowYourLife

Life Area: Financial

Disclaimer: This material is based on my personal experience and has been prepared for informational purposes only. It should not be the only means of your personal finance decision making; please consult a professional advisor before taking action.

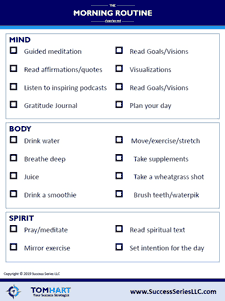

Some of you have attended my Create The LIFE You Want workshop and you would remember much of these personal finance basics from my Saturday afternoon Money module. For those of you who haven’t attended (you can [sign up here for the next one] held closest to you in either LA, Denver, Dallas or KC) here’s a quick lesson in the basics of personal finance:

10 Basics of Personal Finance

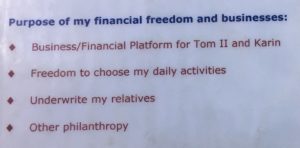

1. Have a reason why money and financial freedom is important to you.

You must know your “Why” to be motivated as to the “What” and “How”.

When I started my first business at age 18, I was motivated to make money because I needed to pay for my college education. When I sold that company, a Southern California-based auto detailing company named Every Last Detail, and went into real estate it was because I was a new father and wanted a more profitable career to provide for my family. Your “why” will motivate you and keep you on track when the inevitable peaks and valleys occur.

I’ve carried this laminated card in my pocket for over 25 years to remind me of my why (Tom II and Karin are my kids):

I’ve carried this laminated card in my pocket for over 25 years to remind me of my why (Tom II and Karin are my kids):

Another advantage of having a “why” is that it’ll cause you to pause when you are tempted to get off-track. When you have a long-term financial goal, it’ll help you say “no” to the short-term temptations in favor of the long-term why. Say “no” to the good so you can say “yes” to the great.

2. Create a Prosperity Mindset.

My good friend, Brian Tracy, puts it this way, “The Law of Expectations says that whatever you expect with confidence, positive or negative, becomes your reality. If you confidently expect to succeed, and hold to that belief, and act as if your success was inevitable, you will eventually achieve that success.”

I’m glad I learned early in life to have an open mind. Doing so opened a world of new ways of being and doing, different from my middle-class suburbia youth. I learned from my earliest of self-improvement books and seminars that I was 100% responsible for my life. That awareness gave me the grace to not be guided by those who may judge me for trying new and different things, but to be open to experimenting, trying new things and if it resonated with me, implement it in my life. This is how I came to learn of the Law of Attraction and Abundance Thinking. I remember a prof in my freshman year of college having “The Magic of Thinking Big“ by David Schwartz as assigned reading in his marketing class. It was a game changer for me.

3. Decide what you want.

You can’t get from where you are to where you want to be if you haven’t defined where you want to be. Know what financial outcome you what. And be specific. It’s not enough to say “I want to be a millionaire by age 35” or “I want to be financially independent.” You must be specific as to where you want to go so you are sure to hit the target. Read up on goal setting including creating SMART goals: Specific Measurable Attainable Realistic and Time bound [here].

Listen to my Talk with Tom podcast episdode on goal setting [here] and then download my FREE 7-Day Goal Setting Challenge eBook – A Guide to Help You Set Your Goals, Create a Plan of Action and Begin Achieving Them IN ONLY A WEEK! [Download it for FREE here].

Listen to my Talk with Tom podcast episdode on goal setting [here] and then download my FREE 7-Day Goal Setting Challenge eBook – A Guide to Help You Set Your Goals, Create a Plan of Action and Begin Achieving Them IN ONLY A WEEK! [Download it for FREE here].

4. Assess where you are.

Again, you can’t get from where you are to where you want to be without first defining where you are financially. Make an honest assessment of your financial picture. Look at your income and expenses (a budget) and create a net worth statement (that is what you own minus what you owe). These two financial statements will give you a pretty good picture as to where you stand financially. Please don’t avoid this step out of shame from past actions or false security from past achievements. This all important step will give you a true picture of where you are and provide you with an accurate starting point for your created financial future.

5. Save as much as you can.

Pay yourself first. I’m sure this isn’t the first time you have heard. Why is it we hear truth spoken and yet resist implementing it for whatever reason? Many have heard the savings rule of thumb of 10% but I take it a bit further. I say, it may be 10%, it may be 2%, it may be 20%. It depends on your long-term financial goals and the purpose of your saving. And, it very much depends on how much earnings you have. If your long-term goal is to have a $1 million retirement nest egg earning an average 6% annual return on that investment to live on that $60,000 per year, your savings rate will be dependent on a number of things. Your savings rate will at least be driven by how long you have til retirement, what annual income you presently earn and what monthly non-discretionary expenses you have.

6. Pay taxes responsibly.

Stay current filing your returns and use the tax code in your favor, especially when it comes to business expenses. Many of my clients are small business owners and I’m always advising them, “Stay within the law but utilize all the many business deductions that are available because you’re helping the national economy with jobs creation, sales tax and B2B transactions.”

By the way…an aside…I was shocked to learn recently that it is projected that by the year 2025, 60% of working-age adults will be self-employed…that’s less than 10 years away. Amazing!

Lastly on taxes, it’s a good thing if you’re paying more in taxes year-over-year that means your income is increasing and your business is growing. Congratulations! P.s. If you find yourself buried in tax debt with little means of ever paying it off, talk to your accountant about doing an Offer in Compromise with the IRS to get it under control and keep current with today’s taxes.

7. Buy insurance – today.

I felt all grown up when I bought my first life insurance policy. It was like I was crossing the threshold of choice of discretionary expenses like kind of car or vacations, into the world of responsible spending. For my millennial clients out there, let me tell you the mistake most people make in buying life insurance is waiting too long to do so. Yes, first you buy car insurance, home or contents insurance, health, and disability insurance, but right after that comes life insurance (p.s. For my boomer clients: after that comes long-term care insurance).

Another tip for you all regarding life insurance: use it as an Estate Planning tool. My will has three tranches of which my life insurance policy contributes to as well: 1) expenses due to cause of death, 2) debt payoff, and 3) inheritance distributions.

8. Shed debt.

We all know by now there is good debt and bad debt. Good debt creates leverage which, when managed properly, can increase an investment’s ROI and its Cash-on-cash return. It’s a must in my real estate investment and development endeavors. I could not possibly pursue the size projects that I have over the course of my career without lender partners, both debt and equity. Bad debt on the other hand, is spending beyond your means with credit cards and other unsecured debt. Rid yourself of this bad debt one step at a time. Here’s the basics: rank your debts according to interest rate. Budget a monthly “Debt payments” amount. Pay slightly above the minimum payment on all but the highest interest rate debt and apply all the rest of that budget category amount to the highest interest rate debt to pay it off as soon as possible, and so on. As you pay off the credit cards, cut them in half keeping one as a “charge card” to be paid off in full as each monthly statement comes in so you build your credit and increase your FICO score to assist you in your ability to get good debt when needed.

9. Invest wisely.

When it comes to investing those dollars saved, allocate your funds into two buckets: a long-term savings bucket (say a Self-directed IRA or a 401k) and a trading account (again self-directed or low flat-fee based account). Do your homework and invest in only the real estate, stocks, Index funds, and other assets that match your knowledge and values. More and more today investors are investing in values-based or socially-responsible investments. Diversify your portfolio to account for the inevitable cycles of the various markets. Start with a risk-analysis relative to your age and personality and allocate each asset class based on your comfort and knowledge. Personally, I live, breathe, sleep and eat real estate so my asset allocation would comfortably have over 50% in real estate. My college roommate…a shout-out to Park…knows stocks better than he knows the back of his hand, so his comfort level translates to a higher allocation of equities than the usual. Learn from the many reputable sources out there and invest wisely and strategically.

10. Give what you can.

Have an abundance mentality when it comes to your philanthropy. Some say a common tithe is 10% of your net income. Give what you can but stretch yourself. The average American gives 2% annually and as a percentage of income, those with lower net worths tend to give a higher percentage. One of the universal laws is that much is asked of he/she who much has been given. Remember too that giving can include your skills and time as well. So if you find yourself unable to give much financially, mentor a youth or give a day of your carpentry talent to a worthy cause. When I was at my low point financially, I contributed my project management skills to an Extreme Home Makeover build and then was asked to come back a year later to do 7 houses in 7 days, a first in the history of the show. Inevitably you, the giver, will receive as much or more fulfillment in giving as the recipient.

Having a Personal Financial Plan will keep you disciplined and on-track. Having a Prosperity Mindset and knowing your “why” will go a long way to manifesting that plan into reality. Treat your Budget as a key tool to achieve your short and long-term financial dreams and soon you will realize financial freedom.

Your Action Step

If you don’t yet have a Personal Financial Plan then start today using the above guidelines. The best time to have planted a tree is 5 years ago…the next best time: TODAY. The above list is somewhat in order of priority so get started today.

Over the next few blog posts I’ll end by giving a few of the 100 Things Successful People Do from author Nigel Cumberland (but not all 100 🙂 Here’s five for starters:

- Follow your dreams

- Ask for help

- Create your future

- Be emotionally intelligent

- Do the opposite.

One of my missions in life is to move and inspire people to live their highest vision. It is my honor and privilege to serve you in this way. I make it an absolute MUST to inspire each and every one of you to STEP UP and live the life of your dreams, NOW, and not settle for less than you can be, do, have, say or believe.

There is no better endorsement than that of a friend, so if you like what you’re reading or are using my many resources, tell a friend to join the Tom Hart Success Series Community, to receive email notifications of new blog posts and Talk with Tom podcast episodes, learn of upcoming events, and other news, by visiting my website and clicking on the offer to receive my FREE monthly resource by leaving their email address (we respect your privacy and do not tolerate spam and will never sell, rent, lease or give away your information to any third party).